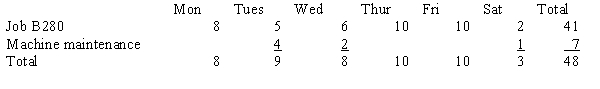

Tyler Jacob is paid $15 per hour for a 40-hour work week with time-and-a-half for overtime, which is not charged to specific jobs. For the week of March 4 - 10, Tyler's labor time record was as follows:  Other Information:

Other Information:

Tyler's year-to-date wages as of March 3 were $7,500. He contributes $20 weekly for his health insurance premiums.

Current tax rates in effect are: FIT withholding rate - 10%; FICA - 8% on the first $100,000 of wages; SUTA - 4% on the first $8,000 of wages; and FUTA - 1% on the first $8,000 of wages.

(a) Calculate Tyler's gross and net pay.

(b) Prepare the journal entries necessary to

(1) Record Tyler's payroll

(2) Pay Tyler's payroll

(3) Distribute Tyler's payroll to the appropriate accounts

(c) Calculate the employer's payroll taxes and prepare the journal entry to record them employer's portion of payroll taxes

Definitions:

Forward Contract

A financial instrument agreement to buy or sell an asset at a predetermined future date and price.

Spot Rate

The present going rate for a specific currency to be purchased or exchanged, available for prompt delivery.

Hedge

A financial strategy used to reduce the risk of adverse price movements in an asset.

Hedge

An investment position intended to offset potential losses or gains that may be incurred by a companion investment, commonly used for risk management.

Q1: The Wagner Company's Schedule of Earnings and

Q5: A local cable TV system using a

Q6: Normal losses that occur in the manufacturing

Q20: Prune Juice Corp. reported the following

Q21: According to IFRS, an operating segment is

Q22: Consider the budget information for Bert and

Q28: Daktari Enterprises' Schedule of Earnings and Payroll

Q28: Mountain Company produced 20,000 blankets in June

Q38: The following are the results of the

Q43: When evaluating profitability of a segment, costs