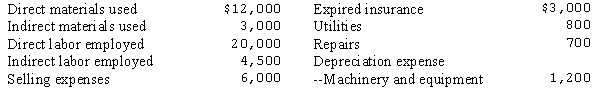

Following is a list of costs incurred by the Sitka Products Co. during the month of June:  Prepare the journal entries necessary to record the issuance of materials, the distribution of labor cost, the recording of factory overhead, and the entry transferring Factory Overhead to Work in Process.

Prepare the journal entries necessary to record the issuance of materials, the distribution of labor cost, the recording of factory overhead, and the entry transferring Factory Overhead to Work in Process.

Definitions:

$1,250

A specific monetary amount, possibly denoting a threshold, tax credit value, or an investment minimum.

Qualifying Widow(er)

A tax filing status allowing a surviving spouse to use joint tax rates for up to two years after the spouse's death, under certain conditions.

Taxpayer Remarry

When a taxpayer remarries, it changes their tax filing status and can affect determinations for deductions, credits, and tax liability.

Single Taxpayer

A filing status for individuals who are not married and do not qualify for other filing statuses, impacting the tax rate and deductions available.

Q14: Which of the following is not an

Q19: Which of the following statements about service

Q20: The Columbus Company has three departments A,

Q22: The following information is available for the

Q29: Oswald Ltd. has recently decided to go

Q32: Which of the following items relating to

Q48: The effective tax rate for a period

Q69: For a manufacturer, the total cost of

Q75: Difference between pensions and other post-employment health-care

Q124: Which statement is correct in comparing capital