Use the following information for questions 16-17.

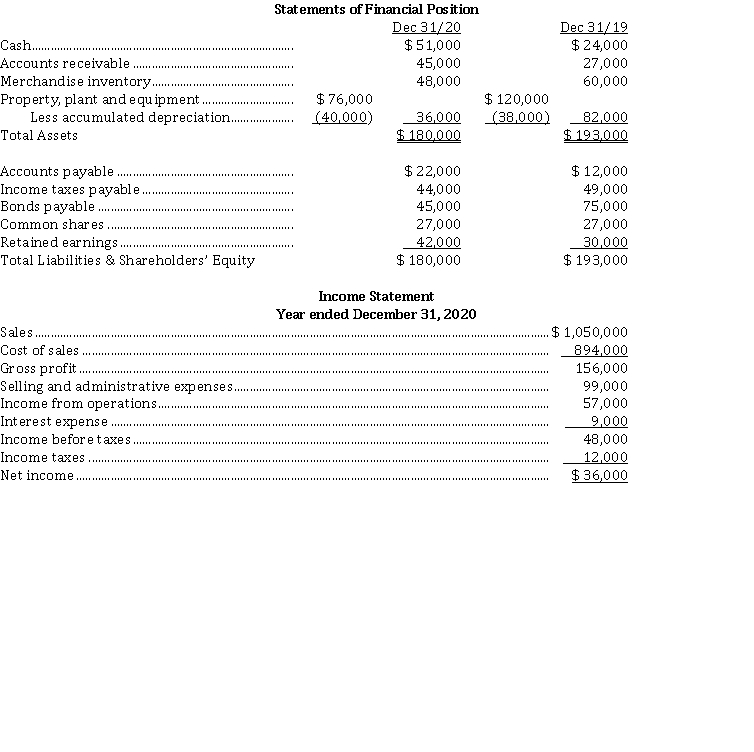

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:  The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

-On a statement of cash flows for calendar 2020, the cash provided by (used in) by financing activities is

Definitions:

Coupon Bonds

Debt securities that pay the holder a fixed interest rate (coupon) over a specified period until maturity, at which point the principal amount is repaid.

Interest Rate Sensitive

Refers to investments or financial instruments that are significantly impacted by changes in interest rates.

Yield To Maturity

The total return anticipated on a bond if held until it matures, factoring in current market price, par value, coupon interest rate, and time to maturity.

Semi-Annual

Occurring twice a year; pertaining to a period of six months.

Q2: Allocating income tax expense or benefit for

Q15: For a lessor, which of the following

Q16: Which of the following budgets is used

Q18: The cash provided by financing activities in

Q27: In calculating the weighted average of common

Q45: A cost driver is:<br>A)An overhead or activity

Q46: Lease criteria for classification by lessor under

Q61: The Lucas Manufacturing Company has two production

Q71: In a defined benefit plan, a formula

Q108: On May 1, 2020, Charles Corp. leased