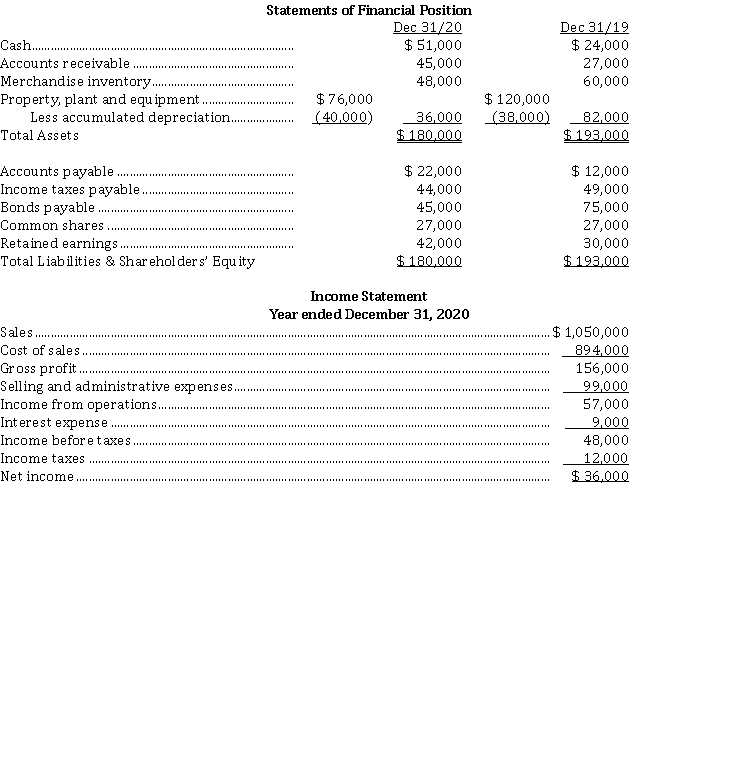

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:  The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1) Dividends declared and paid were $ 24,000.

2) Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3) Bonds were retired during the year at par.

For a statement of cash flows for calendar 2020, using the indirect method, the cash provided by operating activities is

Definitions:

Prepaid Expense

An expense that has been paid in advance and is recorded as an asset until it is actually incurred.

Q10: The method of distributing service department costs

Q10: The statement of costs of goods manufactured

Q20: Alabama Corp.'s taxable income differed from its

Q29: Oswald Ltd. has recently decided to go

Q29: Information concerning Department A of Ali Company

Q49: Asia, Inc., manufactures one product in two

Q52: Basic and diluted earnings per share<br>The following

Q54: Accounting for a direct financing lease by

Q67: Cooper Company had overapplied factory overhead of

Q84: The intrinsic value of an option is