Use the following information for questions.

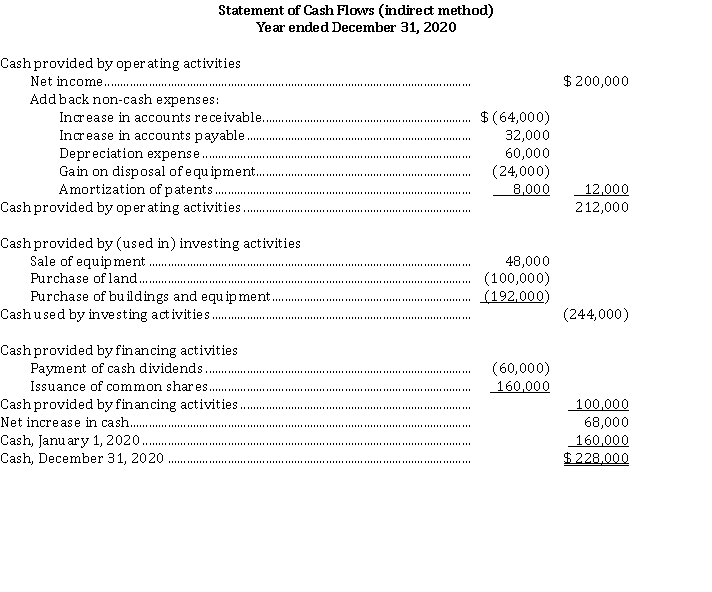

Financial statements for Bernard Corp. are presented below:  BERNARD CORP.

BERNARD CORP.  Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-Ophelia Ltd. reported retained earnings at December 31, 2019 of $ 270,000, and at December 31, 2020, $ 218,000. Net income for calendar 2020 was $ 187,500. During 2020, a stock dividend was declared and distributed, which increased the common shares account by $ 116,500. As well, a cash dividend was declared and paid during the year. The amount of the cash dividend declared and paid was

Definitions:

Q1: Under IFRS 16, the lessee uses the

Q9: Presented below are four segments that

Q18: The records of Andrews Company reflect the

Q30: The payroll summary for EVB Inc. for

Q33: EPS disclosures under IFRS<br>What EPS disclosures are

Q33: Comparing IFRS and ASPE for income tax

Q45: A law firm wanting to track the

Q48: Fixed factory overhead costs include:<br>A)Property taxes.<br>B)Plant manager's

Q56: Comprehensive income tax situation with multiple differences

Q58: Accounting problems for all pension plans may