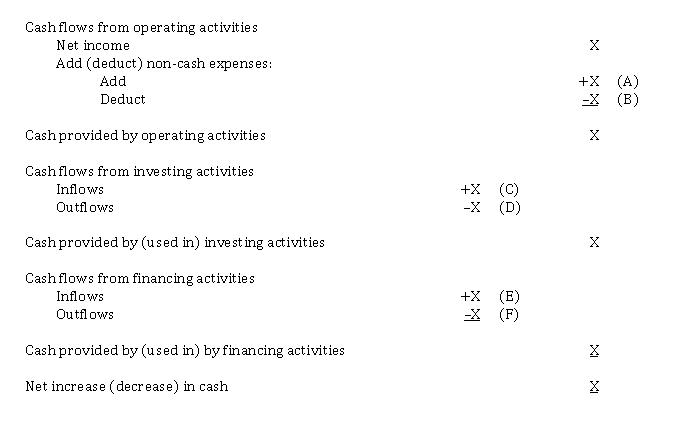

Classification of cash flows (indirect method)

Note that X in the following statement of cash flows identifies a dollar amount and the letters (A) through (F) identify specific items, which appear in the major sections of the statement of cash flows prepared using the indirect method.  Instructions

Instructions

For each of the following items, indicate by letter in the blank spaces below, the section or sections where the effect would be reported assuming the company follows ASPE. Use the code (A through F) from above. If the item is not required to be reported on the statement of cash flows, write the word "none" in the blank. Assume that generally accepted accounting principles have been followed in determining net income and that there are no temporary investments which are considered cash equivalents.

1. Issued preferred shares in exchange for equipment.

2. Accounts receivable increased by $ 60,000.

3. Accrued estimated income taxes for the year.

4. Amortization of premium on bonds payable.

5. Purchase of long-term investment.

6. The book value of FV-NI investments was reduced to fair value.

7. Declaration of stock dividends.

8. Bad debts expense recorded (company uses the allowance method).

9. Gain on disposal of old machinery.

10. Declaration and payment of cash dividends.

11. FV-NI investments sold at a loss.

Definitions:

Political Behavior

Activities aimed at using power and influence within an organization to achieve certain goals.

Gender

Refers to the roles, behaviors, activities, expectations, and societal norms constructed around the concept of sex, influencing individual identity and experiences.

Political Behavior

Refers to actions and attitudes related to power, governance, or policy-making within a group or organization.

Influence Tactics

Techniques or strategies employed by individuals or groups to persuade or influence others to support their objectives or comply with their requests.

Q4: Randall Corp. began operations on January 1,

Q6: Howard Corporation has two production departments. Curing

Q11: Non-counterbalancing error correction<br>Turkey Corp. bought a machine

Q11: Wang Inc. has $ 3,000,000 (par value),

Q37: Joel Williams works at Allentown Company where

Q54: When should process costing techniques be used

Q62: Saucy Inc. reported a taxable and

Q62: The following information pertains to Rembrandt Inc.'s

Q104: For a sales-type lease (ASPE) or manufacturer

Q104: At December 31, 2020, the following information