Cash flows from operating activities (indirect and direct methods)

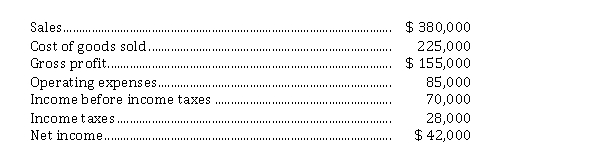

Presented below is the latest income statement of Oxford Ltd.:  In addition, the following information related to net changes in working capital is available: Oxford Ltd. also reports that depreciation expense for the year was $ 13,700 and that the deferred tax liability account increased $ 2,600.

In addition, the following information related to net changes in working capital is available: Oxford Ltd. also reports that depreciation expense for the year was $ 13,700 and that the deferred tax liability account increased $ 2,600.

Instructions

Prepare a schedule calculating the net cash flow from operating activities that would be shown on a statement of cash flows:

a) using the indirect method.

b) using the direct method.

Definitions:

Competitive Move

An action taken by a company to strengthen its position in the market relative to its competitors.

Manufacturing Costs

The total expenses associated with the production of goods, including materials, labor, and overhead costs.

Marketing Costs

Expenses associated with promoting a company's goods or services.

Civil War

An internal conflict between groups within the same country, often over issues of governance, territory, religion, or ethnicity.

Q7: At December 31, 2019, Jack Russell Ltd.

Q8: The following cost is an example of

Q15: Presented below is pension information related to

Q20: Basic and diluted earnings per share<br>Barker Inc.

Q21: In calculating diluted earnings per share, the

Q24: Western Industries pays employees on a weekly

Q41: Taxes payable method and disclosure<br>Gursol Exchange Inc.,

Q42: On January 1, 2019, Condor Corp. acquired

Q55: According to IFRS, a segment of a

Q56: Comprehensive income tax situation with multiple differences