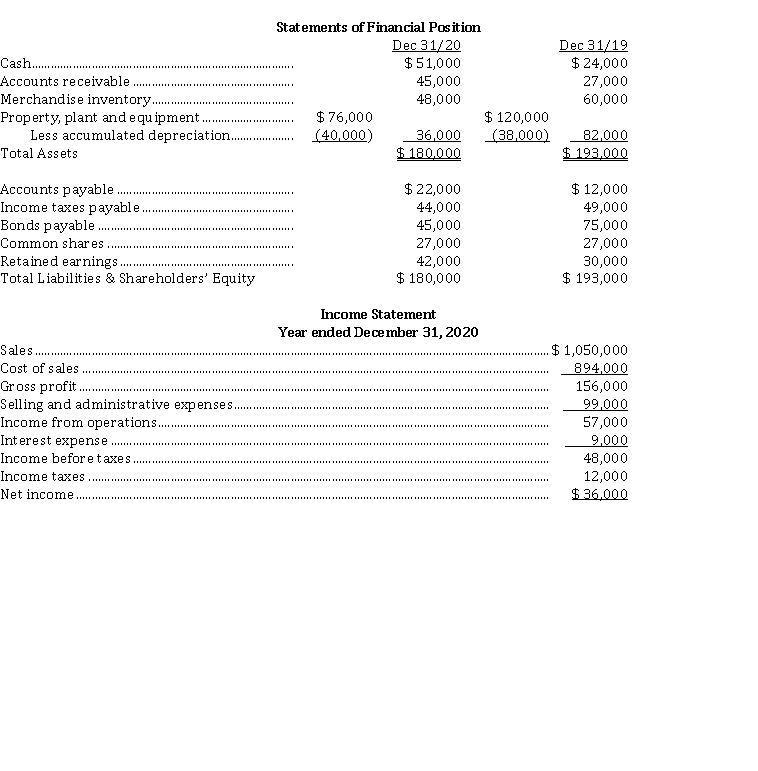

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:  The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

Instructions

From the information above, prepare a statement of cash flows (direct method) for calendar 2020.

Definitions:

Q13: Which of the following costs would not

Q26: In a defined benefit plan, for the

Q35: On January 1, 2020, Marlene Corp. enters

Q39: Lessee accounting-capital lease<br>On January 1, 2020, Fargo

Q45: Types of subsequent events<br>Identify the difference between

Q49: Why does the issuance of a stock

Q52: The balance of the defined benefit obligation

Q62: At December 31, 2020, Grant Corp.'s auditor

Q63: The main difference between IFRS and ASPE

Q68: Deferred Tax Asset and tax law<br>Identify the