Preparation of statement of cash flows (direct method)

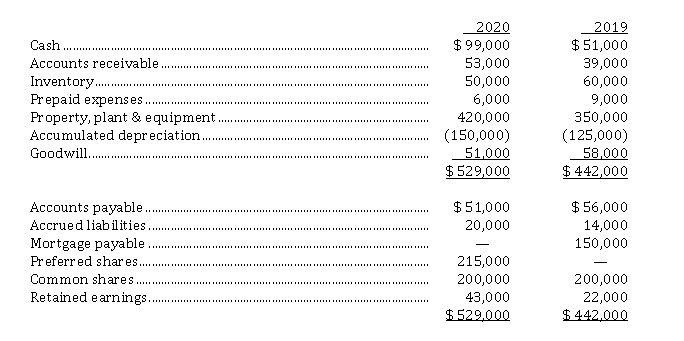

White Horse Ltd. has prepared the following comparative statements of financial position at December 31, 2019 and 2020: White Horse adheres to ASPE.

1. The Accumulated Depreciation account has been credited only for the depreciation expense for the year. There were no disposals of property, plant and equipment, but new equipment was purchased during 2020.

2. Depreciation expense and a charge for impairment of goodwill have both been included in operating expenses.

3. The Retained Earnings account was debited for cash dividends declared and paid of $ 46,000, and credited for the net income for the year.

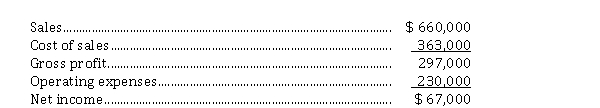

The condensed income statement for 2020 is as follows:  Instructions

Instructions

From the information above, prepare a statement of cash flows (direct method) for calendar 2020.

Definitions:

Inheritance Interest

A legal or equitable right to receive property or assets from the estate of a deceased person.

Sublease

An agreement where the original tenant of a lease rents out their space to another person, transferring some or all of their tenancy rights.

Rent Payments

Periodic payments made by tenants to landlords in exchange for the use of residential or commercial property.

Lease Term

The duration for which a lease agreement is effective, specifying the start and end dates of the rental period.

Q5: To successfully employ an ABC system, a

Q10: Mangey Corp. had the following activity related

Q12: Payroll records for selected employees of Tomco

Q20: The form that serves as authorization to

Q28: Employee future benefits do NOT include<br>A) post-employment

Q28: The accounting system used with JIT manufacturing

Q34: Which of the following does NOT need

Q40: The Lucas Manufacturing Company has two production

Q52: A cost center in a process cost

Q67: Measuring and recording pension expense<br>Pumpkin Ltd.