Use the following information for questions 24-25.

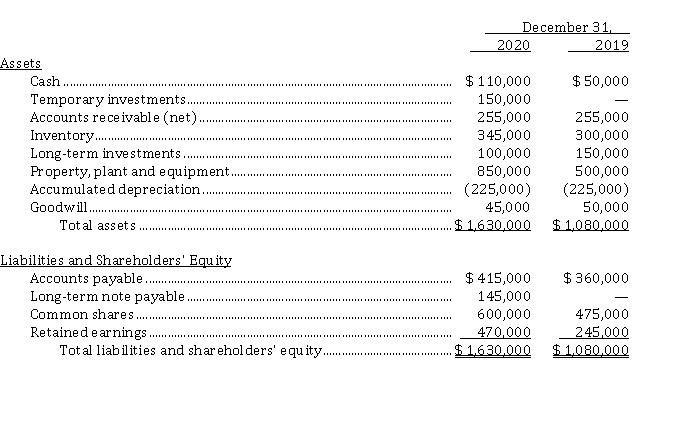

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below:  Other information relating to 2020 activities:

Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash used in investing activities in 2020 was

Definitions:

Monopolists

Entities or individuals that have exclusive control over the supply of a particular good or service, potentially leading to distorted markets and higher prices.

Internalize

The process of absorbing or incorporating the costs or benefits of a transaction or activity, which were previously external to a market decision-maker, into their own decision-making process.

Nationalized

Refers to industries or assets that have been transferred from private to government ownership.

Best Interest

A principle that guides decisions by prioritizing the benefits and welfare of those affected over other considerations.

Q2: The following data were taken from Middletown

Q10: When an entity is first transitioning to

Q11: Errors and irregularities are defined as

Q13: A wage plan based solely on an

Q30: The ratios that assess management performance are<br>A)

Q43: Material is added at the beginning of

Q47: Ken Astor is a factory worker at

Q48: At December 31, 2019, St. John's Limited

Q62: After the observations of cost and production

Q100: At January 1, 2020, Van Gogh Corp.'s