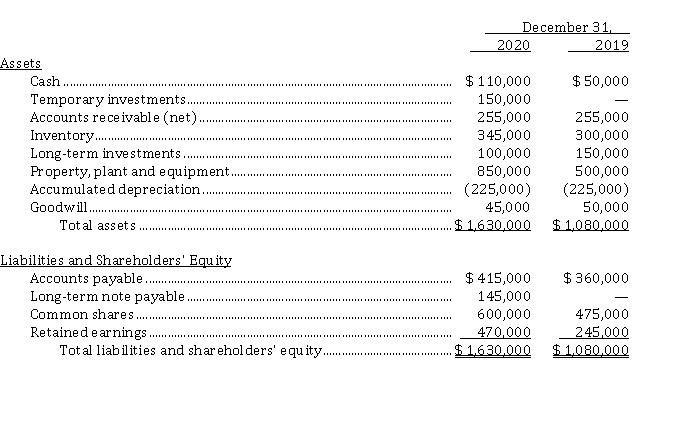

Use the following information for questions 24-25.

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below:  Other information relating to 2020 activities:

Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash provided by financing activities in 2020 was

Definitions:

Saw Palmetto

A plant known for its use in herbal remedies, particularly for urinary symptoms related to an enlarged prostate gland.

Phytosterol Compounds

Naturally occurring compounds found in plant cell membranes that resemble cholesterol structurally and function in lowering LDL cholesterol in humans.

Male Testosterone

A steroid hormone in males that develops and maintains male characteristics and sexual features.

Stretching

A form of physical exercise aimed at improving flexibility and muscle elasticity by extending muscles beyond their normal length.

Q9: Unit cost information is important for making

Q10: Tampa Ltd.'s prepaid insurance balance was $

Q15: Information concerning Department A of Ali Company

Q19: The following information is available for the

Q25: Magritte Inc. provides a defined benefit pension

Q44: A(n) _ requires estimating inventory balances during

Q47: The Reddog Company predicts that 3,200 units

Q50: The term "conversion costs" refers to:<br>A)The sum

Q53: On January 1, 2020, Wings Inc. purchased

Q59: Lessee and lessor accounting (sale-leaseback)<br>On January 1,