Use the following information for questions.

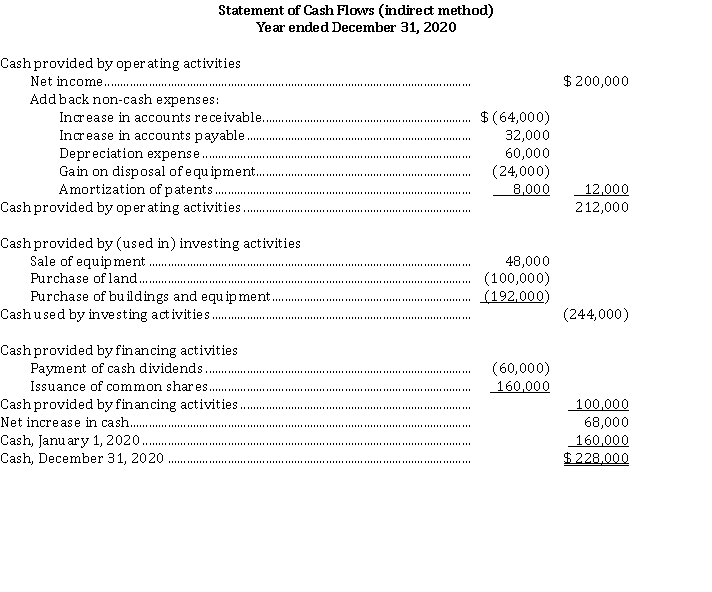

Financial statements for Bernard Corp. are presented below:  BERNARD CORP.

BERNARD CORP.  Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The book value of the buildings and equipment at December 31, 2020 was

Definitions:

Gene Transfer

The process by which genetic material is moved from one organism to another, occurring naturally or through genetic engineering techniques.

Reproduction

The process by which new individuals are produced. See asexual reproduction and sexual reproduction.

Continental Drift

The gradual movement of continents across the earth's surface over geological time, driven by plate tectonics.

Biological Species

A group of organisms capable of interbreeding and producing fertile offspring, sharing common characteristics.

Q1: Which of the following statements is true?

Q2: Allocating income tax expense or benefit for

Q4: and differentiate between the main types of

Q13: One objective of interperiod tax allocation is

Q20: Prune Juice Corp. reported the following

Q37: For calculating income tax expense, ASPE allows

Q39: A corporation records an unrealized loss on

Q42: The cash used in investing activities for

Q47: Joint costs are commonly allocated based upon

Q51: EPS is normally<br>A) on the income statement