Use the following information for questions.

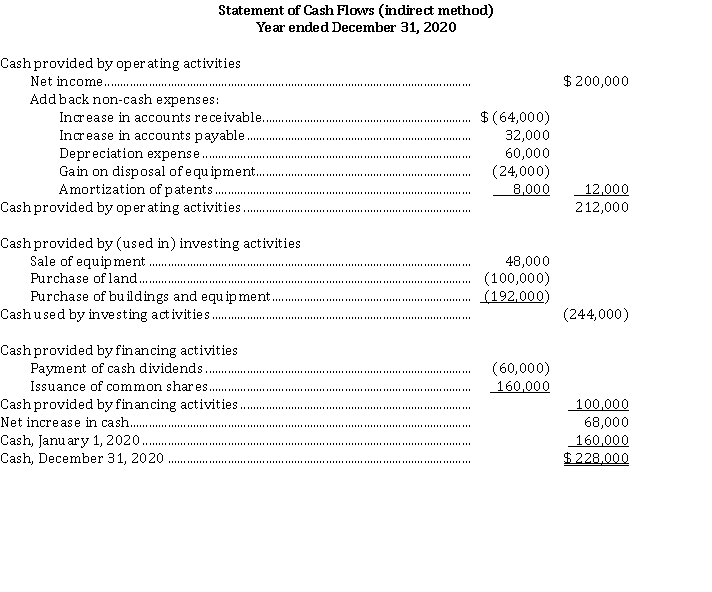

Financial statements for Bernard Corp. are presented below:  BERNARD CORP.

BERNARD CORP.  Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The balance in the Accounts Payable account at December 31, 2020 was

Definitions:

Coupon Rate

The yearly percentage rate of interest that is paid on a bond, relative to its nominal value.

Yield To Maturity

The total return anticipated on a bond if the bond is held until it matures, accounting for its current market price, face value, interest rate, and time to maturity.

Face Value

The original cost of a security or bond, as printed on the certificate, which does not change over time.

Coupon Rate

The interest rate specified on a bond or other fixed income security that the issuer promises to pay to the holder until maturity.

Q15: Presented below is pension information related to

Q21: The cost of production summary for Maha

Q25: Which of the following firms is least

Q35: In calculating cash flows from operating activities,

Q46: Becky Graham earns $15 per hour for

Q48: Fixed factory overhead costs include:<br>A)Property taxes.<br>B)Plant manager's

Q56: On January 1, 2017, Cumberland Ltd. bought

Q67: Measuring and recording pension expense<br>Pumpkin Ltd.

Q82: How should employers recognize employee benefit plans

Q106: Rounded to the nearest dollar, the amount