Use the following information for questions.

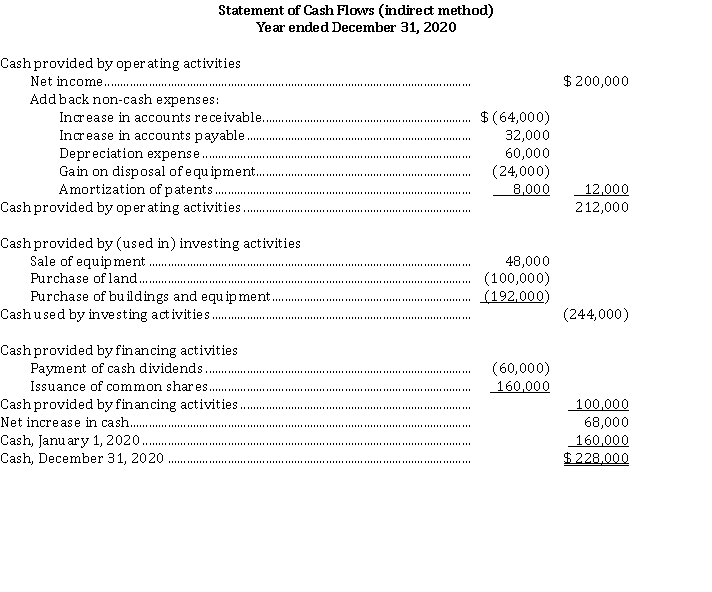

Financial statements for Bernard Corp. are presented below:  BERNARD CORP.

BERNARD CORP.  Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-Ophelia Ltd. reported retained earnings at December 31, 2019 of $ 270,000, and at December 31, 2020, $ 218,000. Net income for calendar 2020 was $ 187,500. During 2020, a stock dividend was declared and distributed, which increased the common shares account by $ 116,500. As well, a cash dividend was declared and paid during the year. The amount of the cash dividend declared and paid was

Definitions:

Current Costs

The cost associated with purchasing goods or services in the present time, often used in accounting to refer to the cost of inventory or services consumed.

Weighted Average Method

An inventory costing method that assigns a cost to inventory items based on the weighted average cost of all similar items purchased or produced during a period.

Inventory Items

Goods or materials that a company holds for the ultimate goal of resale or production.

Costing Method

An accounting approach to evaluate and determine the cost of goods sold and ending inventory.

Q7: In the financial statements, Materials should be

Q14: Measuring and recording pension expense<br>The following information

Q25: Which of the following firms is least

Q43: Carrying costs would include all of the

Q44: The production report for Phillips Industries, which

Q52: Explain how management should apply accounting policies

Q65: At December 31, 2019 and 2020, Danish

Q68: All of the following increase the value

Q92: The difference between the defined benefit obligation

Q113: A lessee reported a ten-year capital lease