Preparation of statement of cash flows (format provided)

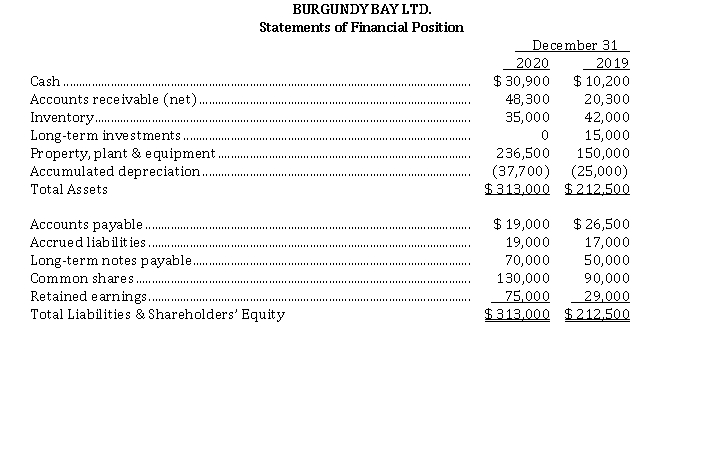

Comparative statements of financial position for Burgundy Bay Ltd. are shown below: Burgandy adheres to ASPE.  Additional information concerning transactions and events during 2020:

Additional information concerning transactions and events during 2020:

1. Net income was $ 80,000.

2. Sold the long-term investments for $ 28,000.

3. Paid cash dividends of $ 34,000.

4. Purchased machinery costing $ 26,500, paid cash.

5. Purchased machinery by signing a $ 60,000 long-term note payable.

6. Extinguished a $ 40,000 long-term note payable by issuing common shares.

Instructions

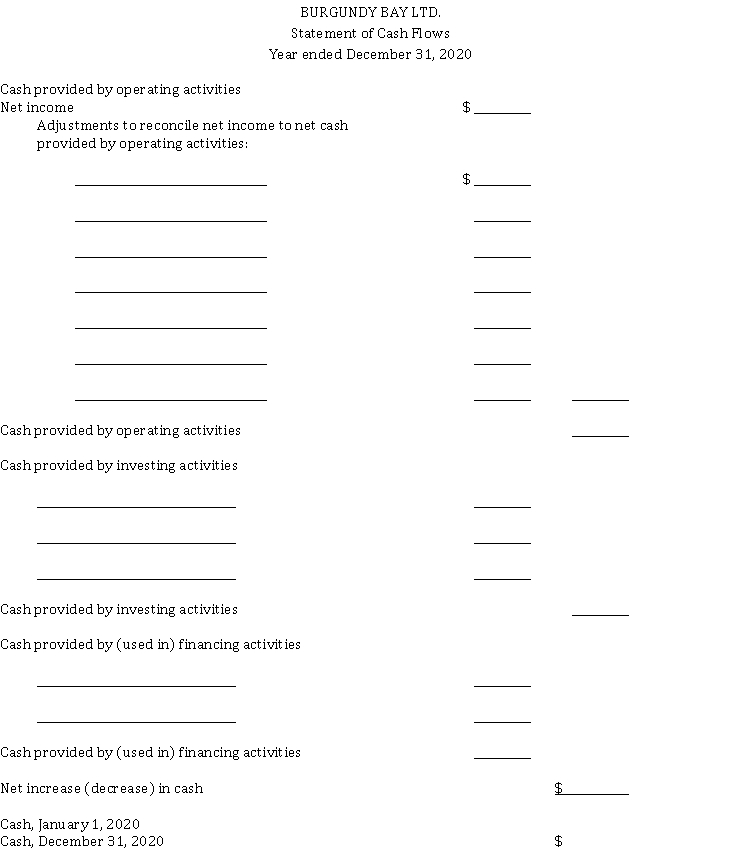

Using the format provided on the next page, prepare a statement of cash flows (indirect method) for calendar 2020 for Burgundy Bay Ltd.

Definitions:

Administrative Expenses

Costs related to the general operation of a business that are not directly linked to production or sales, such as salaries of office staff and utilities.

Cash Disbursements

The payments a company makes during a period, including expenses, debt payments, and purchase of assets.

Manufacturing Overhead

Indirect factory-related costs that are incurred when producing a product, including costs associated with maintenance, utilities, and quality control.

Fixed Selling Expenses

Fixed selling expenses are those costs associated with selling a product that do not change with the level of production or sales, such as salary of sales staff and rent for office space.

Q2: Presented below is information related to Peach

Q5: As part of its disclosure initiative, why

Q7: Initial measurement of right-of-use asset and lease

Q15: Information concerning Department A of Ali Company

Q18: The form used to notify the purchasing

Q22: Taylor Logan is an accountant with the

Q25: The number of workers in the departments

Q30: Which of the following statements is INCORRECT?<br>A)

Q36: Under a job order system of cost

Q74: Santorini Ltd. has accumulated the following data