Preparation of statement of cash flows (indirect method)

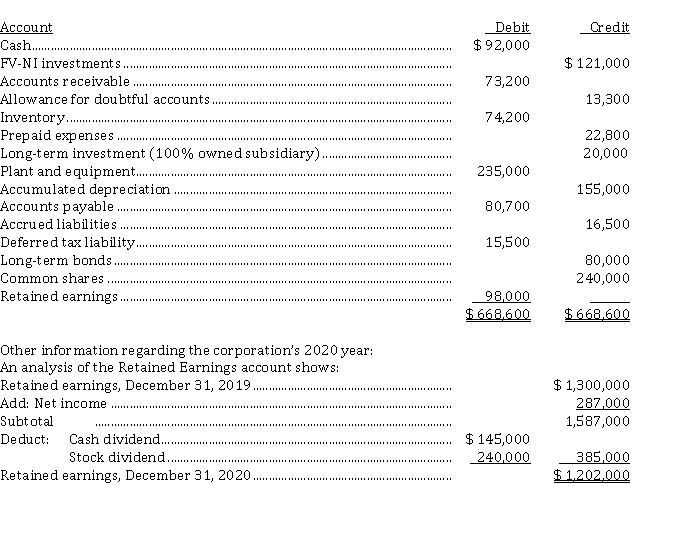

The net changes in the statement of financial position accounts of Brown Derby Corp. for calendar 2020 are shown below. Brown Derby adheres to ASPE.

1. On January 2, 2020, FV-NI investments costing $ 121,000 were sold for $ 150,000.

2. The company paid the cash dividend on February 1, 2020, and distributed the stock dividend on August 1, 2020.

3. Accounts receivable of $ 16,200 and $ 19,400 were considered uncollectible and written off in 2020 and 2019, respectively.

4. Major repairs of $ 25,000 to the equipment were debited to the Plant and Equipment account during the year.

5. The 100% owned subsidiary reported a net loss for the year of $ 20,000.

6. At January 1, 2020, the cash balance was $ 136,000.

7. Long-term bonds were issued at par.

Instructions

Prepare a statement of cash flows (indirect method) for calendar 2020.

Definitions:

Poisson Distribution

A probability distribution that expresses the probability of a given number of events occurring in a fixed interval of time or space, assuming that these events occur with a known constant rate and independently of the time since the last event.

Hypergeometric Random Variable

A type of discrete random variable that describes the number of successes in a sequence of draws from a finite population without replacement.

With Replacement

A sampling method where each item is replaced back into the population before the next item is selected, allowing for repeated selection.

Defective Units

Items in a production batch that do not meet the required quality standards or specifications.

Q6: Economic reasons for changing accounting policies<br>Discuss possible

Q13: When the equipment was sold, the Buildings

Q22: Presented below is pension information related to

Q34: Which of the following is NOT a

Q35: In calculating cash flows from operating activities,

Q38: The Dehl Company payroll for the first

Q60: What is the amount of depreciation expense

Q67: Measuring and recording pension expense<br>Pumpkin Ltd.

Q70: The most appropriate basis for allocating the

Q90: Calculation of lease amounts for lessor for