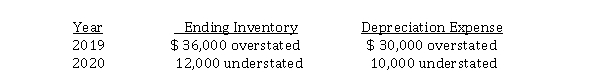

Eagle Corp. is a calendar-year corporation whose financial statements for 2019 and 2020 included errors as follows:  Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use, representing the cumulative wear and tear or obsolescence of the asset.

Contra

Contra refers to an account that is used to reduce another account on the financial statements to its net value.

Plant Asset

Long-term tangible assets used in the operation of a business and not intended for resale, such as machinery, buildings, and vehicles.

Loss

The negative result when expenses exceed revenues during a specific period.

Q23: Macbeth Corp.'s comparative statements of financial position

Q24: Effects of transactions on the statement of

Q30: The statements of financial position for King

Q32: When preparing a statement of cash flows

Q54: A reconciliation of Quebec Corp.'s pre-tax

Q55: Sam Jones works at Seeker, Inc. Sam's

Q59: Pension accounting terminology<br>Briefly explain the following terms<br>a)

Q78: On their 2020 income statement, how much

Q87: For convertible securities, the portion relating to

Q88: Under IFRS for employee future benefits besides