Accounting for accounting changes and error corrections

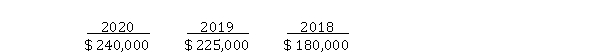

Parrot Corp. reported net incomes for the last three years as follows:  During the 2020 year-end audit, the following items come to your attention:

During the 2020 year-end audit, the following items come to your attention:

1. Parrot bought a truck on January 1, 2017 for $ 98,000 cash, with an $ 8,000 estimated residual value and a six-year life. The company debited an expense account for the entire cost of the asset. Parrot uses straight-line depreciation for all trucks.

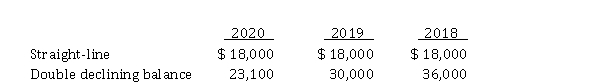

2. During 2020, Parrot changed from straight-line depreciation for its cement plant to double declining balance. The following calculations present depreciation on both bases:  The net income for 2020 was calculated using the double declining balance method.

The net income for 2020 was calculated using the double declining balance method.

3. In reviewing its provision for uncollectible accounts during 2020, the corporation has determined that 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1/2 of 1% as its rate in 2019 and 2018 when the expense had been $ 9,000 and $ 6,000, respectively. Parrot recorded bad debt expense using the new rate for 2020. If they had used the old rate, they would have recorded $ 3,000 less bad debt expense on December 31, 2020.

Instructions (Ignore all income tax effects)

a) Prepare the general journal entry required to correct the books for the item 1 situation (only) of this problem, assuming that the books have not been closed for 2020.

b) Present comparative income statement data for the years 2018 to 2020, starting with income before the cumulative effect of any accounting changes.

c) Assume that the beginning retained earnings balance (unadjusted) for 2018 was $ 630,000. At what adjusted amount should the beginning retained earnings balance for 2018 be shown, assuming that comparative financial statements were prepared?

d) Assume that the beginning retained earnings balance (unadjusted) for 2020 is $ 900,000 and that comparative financial statements are not prepared. At what adjusted amount should this beginning retained earnings balance be shown?

Definitions:

Solar Cameras

are surveillance or imaging devices powered by solar panels, harnessing sunlight to operate wirelessly, often used in remote or outdoor locations for monitoring purposes.

Sustainable Development

A process of development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

Environmental Resources

Natural resources and conditions that support life and human economic activities, such as water, air, soil, and minerals.

Societal Needs

The basic requirements essential for communities and societies to function, such as food, shelter, health care, and education.

Q6: Economic reasons for changing accounting policies<br>Discuss possible

Q10: When an entity is first transitioning to

Q21: The cost of production summary for Maha

Q23: Cost accounting differs from financial accounting in

Q28: Convertible bonds<br>Miron Construction Ltd. offers five-year, 8%

Q40: Explain the three steps that should be

Q64: Payroll is debited and Wages Payable is

Q69: On April 7, 2020, Soweto Corp. sold

Q81: Using the indirect method, an increase in

Q103: When the plan assets of a pension