Error corrections and adjustments

The controller for Stork Corp. is concerned about certain business transactions that the company experienced during 2020. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below:

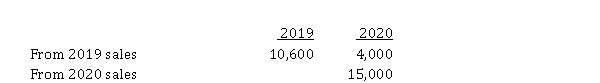

1. The company has decided to switch from the direct write-off method for accounting for bad debts to the percentage-of-sales approach. Assume that Stork has recognized bad debt expense as the receivables have actually become uncollectible in the following way:  The controller estimates that an additional $ 21,800 in bad debts will be written off in 2021: $ 3,800 applicable to 2019 sales and $ 18,000 to 2020 sales.

The controller estimates that an additional $ 21,800 in bad debts will be written off in 2021: $ 3,800 applicable to 2019 sales and $ 18,000 to 2020 sales.

2. Inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such (on account). At December 31, 2020, inventory billed and in the hands of consignees amounted to $ 160,000. The percentage markup on selling price is 20%. Assume that the consigned inventory is sold the following year. The company uses the perpetual inventory system.

3. During 2020, Stork sold $ 300,000 worth of goods on the instalment basis. The cost of sales associated with these instalment sales is $ 225,000. The company inadvertently handled these sales and related costs as part of their regular sales transactions. Cash of $ 86,000, including a down payment of $ 30,000, was collected on these instalment sales during 2020. Due to questionable collectability, the instalment method was considered appropriate.

Instructions

a) Assume that Stork Corp. reported pre-tax income of $ 500,000 for 2020. Present a schedule showing the corrected pre-tax income after the above transactions are taken into account. Ignore income tax effects.

b) Prepare the correcting journal entries required at December 31, 2020, assuming that the books have been closed.

Definitions:

Equivalent Units

A term used in cost accounting to represent a conversion of partially completed goods into a number of fully completed units.

Direct Materials

Raw materials that are directly traceable to the production of a specific good or service and directly incorporated into the final product.

Direct Labor

The wages paid to workers who are directly involved in the production of goods or the provision of services.

Equivalent Units Of Production

A concept in cost accounting that converts units of production into the amount of finished goods units.

Q7: A deferred tax liability is the<br>A) current

Q9: Oyster Corp. reports its income from investments

Q41: The type of merchandiser who purchases goods

Q47: The journal entries for Capital (ASPE) or

Q49: On January 1, 2020, Marlene Corp. enters

Q49: The method of analyzing the behavior of

Q51: Umberg Merchandise Company's cost of goods sold

Q61: At issuance, the cash proceeds from the

Q62: The following information pertains to Rembrandt Inc.'s

Q124: Which statement is correct in comparing capital