Use the following information for questions.

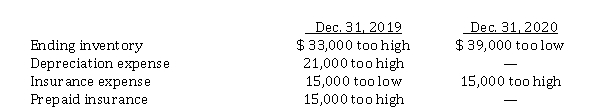

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's 2020 net income is

Definitions:

Unconditional Positive Regard

A concept in psychology that implies complete acceptance and support of a person regardless of what they say or do, particularly in a therapist-client relationship.

Power Motivation

The drive to influence others and achieve a position of authority or control in a social or professional context.

Intrinsic Goals

Personal growth, affiliation, and community feeling.

Personal Growth

An individual’s process of developing self-awareness, knowledge, and improving personal skills and qualities over time.

Q2: The materials account of the Herbert Company

Q5: When is a lease recognized as an

Q32: Which of the following items relating to

Q41: Laurel Ltd. leased an office building to

Q44: Classification of cash flows (indirect method)<br>Note that

Q46: Becky Graham earns $15 per hour for

Q50: Which of the following costs would be

Q59: The underlying principle of the retrospective application

Q60: below is the latest income statement

Q93: Raphael Inc. provides a defined benefit plan