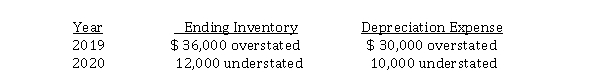

Eagle Corp. is a calendar-year corporation whose financial statements for 2019 and 2020 included errors as follows:  Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

Definitions:

Lockbox System

A service provided by banks to companies for the receipt of payment from customers, where payments are sent to a special post office box rather than to the company.

Treasury Bills

Short-term government securities issued at a discount from their face value, with maturities ranging from a few days to 52 weeks.

Collection Time

The average duration it takes for a company to collect payments owed by its customers, often measured in days.

Average Daily Receipts

The average amount of money a business receives on a day-to-day basis over a specified period.

Q7: At December 31, 2019, Jack Russell Ltd.

Q17: On January 1, 2020, Marlene Corp. enters

Q21: According to IFRS, an operating segment is

Q42: The cash used in investing activities for

Q49: Why does the issuance of a stock

Q51: Calculation of lease amounts for lessor for

Q55: Stockton Ltd. changed its inventory system from

Q55: According to IFRS, a segment of a

Q59: During 2020, Madrid Ltd. had 200,000 common

Q63: The employee who is responsible for preparing