Effects of errors on net income

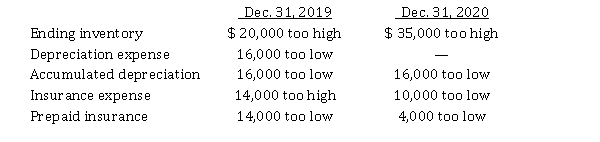

Hummingbird Corp. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 26, 2020, fully depreciated equipment was sold for $ 19,000, but the sale was not recorded until 2021. No corrections have been made for any of the errors.

In addition, on December 26, 2020, fully depreciated equipment was sold for $ 19,000, but the sale was not recorded until 2021. No corrections have been made for any of the errors.

Instructions

Ignoring income tax, show your calculation of the total effect of the errors on 2020 net income.

Definitions:

Residential Housing

Properties used specifically for dwelling purposes, including houses, apartments, and townhomes.

Mortgage Payments

These are regular payments made by a borrower to a lender, typically consisting of both principal and interest, for the loan used to purchase property.

Present Value

The present-day valuation of a future lump sum or cash flow sequence, taking into account a defined rate of return.

Discounting Periods

The intervals at which cash flows are discounted back to their present value in financial analysis.

Q10: Lily Corporation uses process costing to calculate

Q12: At December 31, 2020, Helium Corp. had

Q13: An auditor's adverse opinion<br>A) although very rare

Q21: Accounting for accounting changes and error corrections<br>Parrot

Q21: Convertible bonds<br>A) have priority over all other

Q30: The time value of an option is

Q49: The data used to calculate the order

Q80: Horatio Corp. sold some of its plant

Q85: Stock options<br>Prepare the necessary entries from January

Q93: IFRS 16 classification of leases<br>Under the new