Use the following information for questions.

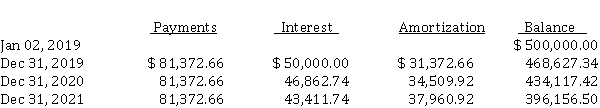

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-The total lease-related expenses recognized by the lessee during 2020 are (rounded to the nearest dollar)

Definitions:

Q5: Rowe Co.'s Job 401 for the manufacture

Q11: Preparation of statement of cash flows (direct

Q19: The December 31, 2020 condensed balance sheet

Q44: Classification of cash flows (indirect method)<br>Note that

Q45: The materials account of the Herbert Company

Q61: As part of the IASB's Disclosure Initiative

Q90: Bissau Ltd. issued $ 4,000,000, 5-year, 8%

Q102: On January 1, 2020, X-Man Corp. signed

Q143: To the nearest percent, the rate of

Q150: Assuming that $ 21,000 will be distributed