Use the following information for questions.

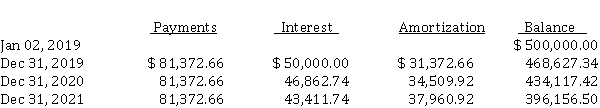

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-What is the amount of the lessee's obligation to the lessor after the December 31, 2021 payment? (Round to the nearest dollar.)

Definitions:

Sugarcane Crop

Sugarcane crop refers to the cultivation of sugarcane, a tropical plant used primarily for the production of sugar and sweeteners, biofuel, and other byproducts.

Accounting Definition

Refers to the systematic process of recording, measuring, and communicating information about financial transactions.

Financial Resources

Assets in the form of cash, credit, or other financial assets that are available to an individual or organization for use.

Q13: The balance in Kayser Manufacturing Company's Finished

Q13: Order costs would include all of the

Q25: Magritte Inc. provides a defined benefit pension

Q26: Western Industries pays employees on a weekly

Q49: Mason Corp. has estimated that total depreciation

Q64: On January 1, 2020, Marlene Corp. enters

Q66: In a period of rising prices, the

Q73: Vernhey Corporation, which follows ASPE, provides the

Q99: The pension expense to be reported for

Q120: Lease A does not contain a bargain