Use the following information for questions.

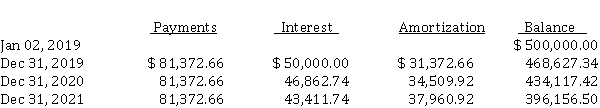

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-The total lease-related income recognized by the lessee during 2020 is

Definitions:

Raymond Cattell

A British and American psychologist known for his psychometric research and the development of several personality and intelligence tests.

Tantrums

Sudden, uncontrolled outbursts of anger and frustration, typically in children.

American South

A region in the United States characterized by its distinct cultural, historical, and social attributes, often associated with states below the Mason-Dixon Line.

Perceived Insults

Refers to the interpretation or understanding of certain actions, words, or behaviors by an individual as being disrespectful or offensive.

Q6: EPS calculations<br>What are the two formulas normally

Q12: All of the following methods may be

Q16: Interim reporting<br>There is ongoing discussion as to

Q17: A difference between IFRS and ASPE's recognition

Q22: MissTake Corp. is a small private corporation

Q29: The form prepared by the purchasing agent

Q36: A speculator's objective is to<br>A) reduce pre-existing

Q43: Convertible bonds<br>Atlanta Ltd. sold convertible bonds at

Q46: What is the objective of the economic

Q49: Permanent and reversible differences<br>Explain whether each of