Use the following information for questions.

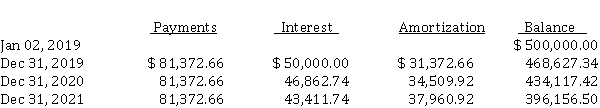

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-What is the interest rate implicit in the amortization schedule presented above?

Definitions:

Standard Costing

A cost accounting method that assigns expected costs to products, which are then compared with actual costs to measure performance.

Variable Overhead

Overhead costs that fluctuate with changes in production activity levels, such as utilities or materials used in production.

Labour Rate Variance

The difference between the actual cost of labour and the standard or expected cost of labour.

Sales Volume Variances

Sales volume variances represent the difference between the actual quantity of product sold and the expected quantity sold, indicating market performance or operational efficiency.

Q5: To two decimals, Power Corp.'s current ratio

Q38: At the end of 2020, its

Q47: On January 1, 2020, Miner Corp. changed

Q49: The data used to calculate the order

Q51: Umberg Merchandise Company's cost of goods sold

Q59: Downsview Corp. reported net income for

Q80: In 2019, Algiers Inc. issued 10,000 no

Q81: Recording a manufacturer/dealer lease<br>On January 1, Lexy

Q126: A capital lease, as compared to an

Q129: Hamilton Ltd. has both common shares and