Use the following information for questions.

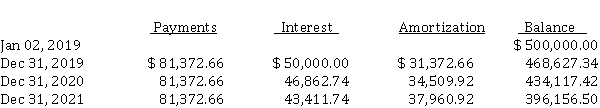

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-What is the amount of the lessee's obligation to the lessor after the December 31, 2021 payment? (Round to the nearest dollar.)

Definitions:

Poorly Fitting Shoes

Footwear that does not properly fit, potentially causing foot pain, blisters, or other discomforts.

Ingrown Toenail

A common condition where the edge or corner of a toenail grows into the surrounding skin, causing pain and sometimes infection.

Tinea Pedis

A fungal infection of the skin of the feet, commonly known as athlete's foot.

Bed Bath

A method of bathing someone who is in bed and unable to bathe themselves, typically involving washing the body with cloths or sponges and no need to rinse off with water.

Q7: A publicly accountable enterprise changes from straight-line

Q7: A deferred tax liability is the<br>A) current

Q19: When convertible debt is converted to common

Q37: Segmented reporting<br>Tangerine Corporation's most recent (condensed)

Q41: Jesse Corp. owns 4,000,000 shares of James

Q51: EPS is normally<br>A) on the income statement

Q72: The following inventory data relate to the

Q76: If a SAR is determined to be

Q86: Credit risk is the risk that<br>A) an

Q97: On May 1, 2020, when the market