Use the following information for questions.

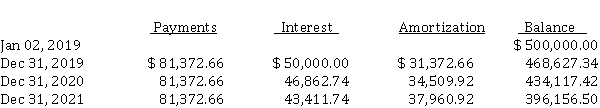

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-The total lease-related income recognized by the lessee during 2020 is

Definitions:

Right to Cancel

The legal ability to terminate a contract or agreement within a specific timeframe without penalty or obligation.

Monthly Installments

A method of paying off a debt through regular payments spread over a period of time, typically charged monthly.

Consumer Transaction

A deal or trade between a seller and a purchaser for goods or services, typically involving personal, family, or household items.

Recall and Destruction

The process of officially ordering the return of a product due to safety concerns or defects, followed by its disposal or destruction.

Q6: EPS calculations<br>What are the two formulas normally

Q17: Jerrod Sampson is paid $10 an hour

Q25: Depreciation expense for 2020 was<br>A) $ 86,000.<br>B)

Q35: Which of the following is NOT a

Q42: On January 1, 2019, Condor Corp. acquired

Q56: At December 31, 2019, Grieger Corp. had

Q59: The underlying principle of the retrospective application

Q63: The Owens Company uses the machine hour

Q65: At December 31, 2019 and 2020, Danish

Q77: Which of the following is a correct