Measuring and recording pension expense

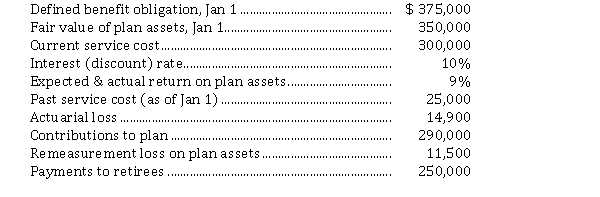

Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2020. The corporation uses IFRS.  Instructions

Instructions

a) Calculate the pension expense to be reported on the income statement for 2020.

b) Calculate the amount to be shown as OCI for 2020.

c) Calculate the fair value of the plan assets at December 31, 2020.

d) Prepare the journal entries to reflect the accounting for the company's pension plan for the year ending December 31, 2020.

Definitions:

Industry Life Cycle

Stages through which firms typically pass as they mature.

Market Penetration

A measure of the extent of sales or adoption of a product or service compared to the total theoretical market for that product or service.

Rapid Growth

A phase in which a company or economy experiences significantly faster-than-average increases in revenue or expansion.

Appreciating

The increase in the value of an asset over time, which can occur due to various factors such as inflation, changes in interest rates, or increased demand.

Q2: Allocating income tax expense or benefit for

Q25: While corporations have varied reasons for purchasing

Q31: The ratios that reflect financial strength are<br>A)

Q32: At the end of 2020, its

Q57: What effect do accounting changes have on

Q69: Antidilutive securities<br>A) should be included in the

Q69: On April 7, 2020, Soweto Corp. sold

Q80: Which of the following statements is correct?<br>A)

Q91: For companies engaged in direct financing leases

Q92: The present value of the principal is<br>A)