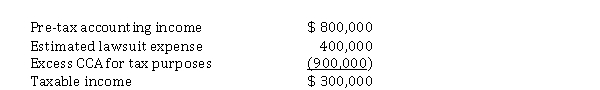

At the end of 2020, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

Definitions:

Tumor

An abnormal mass or growth of tissue that can be benign (non-cancerous) or malignant (cancerous).

Neoplasm Table

A structured list or database used in healthcare contexts to classify and reference different types of tumors or neoplasms.

Anatomical Site

A specific location on or within the body.

Malignant Primary

Referring to an initial cancerous tumor that originates and develops in one site before potentially spreading to other body parts.

Q9: Presented below are four segments that

Q13: Accounting for a capital lease by the

Q19: The December 31, 2020 condensed balance sheet

Q31: In calculating diluted earnings per share, the

Q40: If a long-term note is issued with

Q49: Why does the issuance of a stock

Q52: Explain how management should apply accounting policies

Q60: Custom Cabinets Inc. manufactures goods on a

Q70: Which of the following transactions would NOT

Q81: Using the indirect method, an increase in