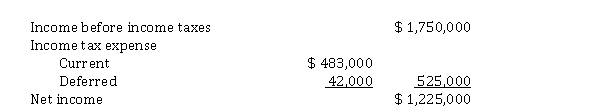

Columbia Corp.'s partial income statement for its first year of operations is as follows:  Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $ 700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $ 700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Definitions:

Chief Accounting Manager

A high-level executive responsible for overseeing a company's accounting activities and financial record-keeping.

Controller

A senior financial officer in an organization responsible for overseeing accounting and financial reporting.

Contingency Plan

A strategy or plan developed to take into account unforeseen events or emergencies to mitigate their potential impact on operations.

Bankruptcy

Legal nonpayment of financial obligations.

Q4: Randall Corp. began operations on January 1,

Q24: Which of the following is most likely

Q28: Employee future benefits do NOT include<br>A) post-employment

Q31: In calculating diluted earnings per share, the

Q32: IFRS 16 effective date<br>When is the effective

Q41: Jesse Corp. owns 4,000,000 shares of James

Q46: Shareholders' equity is generally classified into two

Q73: Basic earnings per share<br>Assuming there were no

Q76: The rate of interest actually earned by

Q89: Disclosure analysis<br>Given there is a significant amount