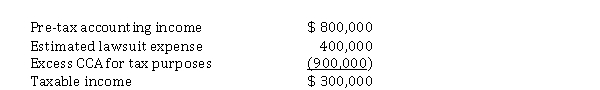

At the end of 2020, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

Definitions:

Sigmoidoscopy

A medical procedure involving the examination of the lower part of the large intestine using a flexible tube with a light and camera.

Urinalysis

A diagnostic test analyzing urine for the presence of diseases, infections, or other medical conditions.

Digital Rectal Exam

A medical examination where a doctor inserts a lubricated, gloved finger into the rectum to check for abnormalities of organs or other structures in the pelvis and lower abdomen.

Pulmonary Function Test

Medical tests that measure the lungs' ability to take in and exhale air as well as their efficiency in transferring oxygen into the blood.

Q19: When a lessee is accounting for a

Q26: Deferred income taxes<br>Seenath Ltd., at the

Q28: Convertible bonds<br>Miron Construction Ltd. offers five-year, 8%

Q32: At the end of 2020, its

Q33: The Institute of Management Accountants (IMA) Statement

Q55: Dilutive convertible securities must be used in

Q65: Dividends on preferred shares<br>At December 31, 2020,

Q66: When calculating diluted earnings per share, convertible

Q82: On July 1, 2020, Juba Inc. issued

Q131: A mining company declared a liquidating dividend.