Interperiod tax allocation with change in enacted tax rates

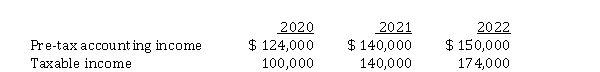

Harrow Corp. purchased equipment for $ 180,000 on January 2, 2020, its first day of operations. For book purposes, the equipment will be depreciated straight-line over three years with no residual value. Pre-tax accounting incomes and taxable incomes are as follows:  The reversible difference between pre-tax accounting income and taxable income is due solely to the use of CCA for tax purposes.

The reversible difference between pre-tax accounting income and taxable income is due solely to the use of CCA for tax purposes.

Instructions

a) Prepare the adjusting journal entries to record income taxes for all three years (expense, deferred tax assets/liabilities, etc.), assuming that the enacted income tax rate for all three years is 30%.

b) Prepare the adjusting journal entries to record income taxes for all three years (expense, deferred tax assets/liabilities, etc.), assuming that the enacted income tax rate for 2020 is 30% but that in the middle of 2021, Parliament raises the income tax rate to 35%, retroactive to the beginning of 2021.

Definitions:

Axons

Long, slender projections of nerve cells that transmit electrical impulses away from the neuron's cell body.

Early Childhood

A critical developmental period in human life, typically considered to be from birth to eight years old, focusing on rapid physical, cognitive, and emotional growth.

Child Obesity

A medical condition affecting children characterized by an excess amount of body fat, which poses a risk to their health.

Fast Food Restaurants

Eateries that offer quick service and a menu of food items that are prepared and served quickly, often allowing for takeaway or drive-through options.

Q15: Selected information from Hatian Corp.'s 2020 accounting

Q16: McMurray Inc. incurred an accounting and taxable

Q24: The if-converted method of calculating earnings per

Q28: On January 1, 2017, Missoula Corporation bought

Q37: On July 1, 2020, an interest payment

Q52: Under ASPE, if a debt refunding is

Q65: Edgar Inc. reported net income for

Q68: All of the following increase the value

Q77: Compensation expense resulting from a compensatory stock

Q93: The price earnings ratio for 2021 is<br>A)