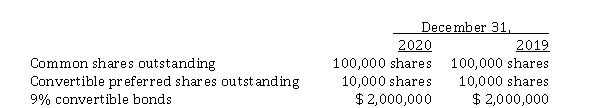

Information concerning the capital structure of Shepherd Corporation follows  During 2020, Shepherd paid dividends of $ 1.00 per common share and $ 2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $ 500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 is

During 2020, Shepherd paid dividends of $ 1.00 per common share and $ 2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $ 500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 is

Definitions:

Production Process

The sequence of operations or steps taken to convert raw materials into finished goods.

Weighted-Average Method

An inventory costing method that assigns a weighted average cost to items, blending the costs of similar items.

Units Transferred

The quantity of goods moved from one process, department, or stage of production to another.

Cost Category

A classification of costs based on their nature or function within a business, often used for accounting and budgeting purposes.

Q9: A put option is a right to<br>A)

Q11: ASPE revenue recognition tests<br>ASPE and IFRS have

Q20: On their 2020 income statement, how much

Q22: EPS presentation<br>When and how is EPS used

Q30: Nicosia Corp. was organized on January 1,

Q44: Income taxes at interim dates<br>Discuss how income

Q105: The objective of accounting for defined benefit

Q129: Hamilton Ltd. has both common shares and

Q157: Reacquisition of shares<br>For numerous reasons, a corporation

Q160: Sarajevo Ltd. currently has outstanding 20,000 no