Use the following information for questions 74-76.

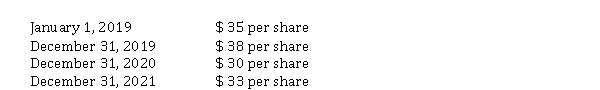

On January 1, 2019, Luanda Ltd. established a stock appreciation rights plan for its executives. This plan entitles them to receive cash at any time during the next four years for the difference between the market price of its common shares and a pre-established price of $ 20, on 50,000 SARs. Market prices of the shares are as follows:  Compensation expense relating to the plan is to be recorded over a four-year period beginning January 1, 2019.

Compensation expense relating to the plan is to be recorded over a four-year period beginning January 1, 2019.

-What amount of compensation expense should Luanda recognize for calendar 2020?

Definitions:

Virtual Piano

A digital application or software that simulates the playing of a piano using a computer keyboard or touchscreen.

Stanzas

Groups of lines forming the basic recurring metrical unit in a poem.

Dorgi

A hybrid dog breed resulting from the crossbreeding of a Dachshund and a Corgi, known for their distinctive short legs and long body.

Schnoodle

A breed of dog that is a cross between a Schnauzer and a Poodle, known for its friendly disposition and hypoallergenic coat.

Q2: During 2020, Neimer Ltd. had 350,000 common

Q22: Night Owl Inc. reports a taxable

Q22: Antigone Corp. issued bonds with detachable common

Q23: On January 2, 2019, Brunswick Corp. purchased

Q25: Magritte Inc. provides a defined benefit pension

Q33: With regard to the measurement of hybrid/compound

Q41: Warrants exercisable at $ 20 each to

Q73: Vernhey Corporation, which follows ASPE, provides the

Q90: In 2020, Elle Corp. acquired 9,000 of

Q122: On December 31, 2019, the shareholders' equity