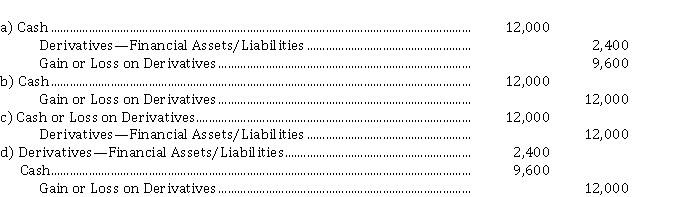

On July 5, 2020, Alpha Corp. purchased a call option for $ 2,400, giving it the right to buy 2,000 shares of Omega Corp. for $ 20 per share. On August 18, 2020, when the option value is $ 12,000, Omega settles the option for cash. The entry on Alpha's books to record the settlement is

Definitions:

Paying Taxes

The mandatory financial charge or other levy imposed on an individual or a legal entity by a governmental organization in order to fund government spending and various public expenses.

Cash Outflow

The movement of money out of a business, resulting from expenses or investments.

Accounts Receivable

Outstanding amounts due from clients to a company for products sold or services utilized, awaiting payment.

Cash Collected

The total amount of money received by a company during a specific period.

Q7: A publicly accountable enterprise changes from straight-line

Q17: The Battle of Mogadishu, during which the

Q20: London Corporation has 50,000 no par value

Q40: Declaration and issuance of a stock dividend<br>A)

Q45: Pineapple owes Dole a $ 600,000, 12%,

Q45: Which of the following should be given

Q50: Under ASPE, if land is the sole

Q56: What are the current International Financial Reporting

Q65: Hills Corp. called an outstanding bond obligation

Q93: Raphael Inc. provides a defined benefit plan