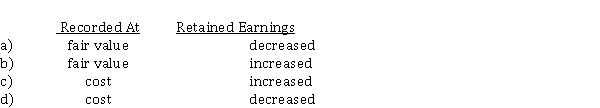

Emily Corp. owned shares in Carr Ltd. On December 1, 2020, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount. As a consequence of the dividend declaration and distribution, the accounting effects would be Property Dividends

Definitions:

Firm's Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time, giving a snapshot of its financial condition.

Generally Accepted Accounting Principles

A collection of commonly followed accounting rules and standards for financial reporting.

CRA

CRA can refer to a Credit Rating Agency, which is an organization that assigns credit ratings to issuers of certain types of debt securities, as well as the debt instruments themselves.

Economic Life

The expected period of time during which an asset is useful to the average owner, or until an asset is projected to generate economic benefits.

Q2: In jurisdictions where par value shares are

Q4: A feature common to both stock splits

Q8: At the end of 2020, its

Q10: How did the Japanese protest their internment

Q17: The Cuban revolutionary leader who overthrew the

Q24: Which of these statements is not true

Q37: Calculating pension components<br>Describe how each of the

Q49: Helix Corporation has 150,000 no par value

Q89: Note disclosures for long-term debt generally include

Q141: Dividends on preferred shares<br>On December 31, 2020,