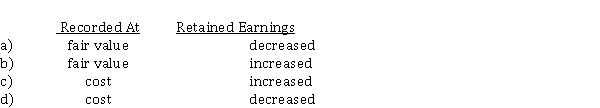

Emily Corp. owned shares in Carr Ltd. On December 1, 2020, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount. As a consequence of the dividend declaration and distribution, the accounting effects would be Property Dividends

Definitions:

Classes

Categories or groups of objects or individuals sharing common attributes, qualities, or characteristics.

Distribution

In syllogistic logic, the term refers to the way in which a term in a categorical proposition is applied to all members of the category it denotes.

Serious Injuries

Injuries that are severe and potentially life-threatening, often requiring immediate medical attention.

Estate

A term often used in law to refer to an individual's property, assets, and liabilities left behind after death.

Q2: The War Refugee Board lifted immigration restrictions

Q5: Accounting for only 10 percent of the

Q10: Entries for bonds payable<br>Prepare the necessary journal

Q29: A fair value hedge protects the company

Q36: A bond's face value is also called<br>A)

Q45: Which of the following statements is INCORRECT

Q75: Under IFRS, if land is the sole

Q77: Under IFRS, the defined benefit obligation is

Q87: On July 1, 2020, Markham Corp. issued

Q100: *Financial reorganization<br>Describe the accounting steps involved in