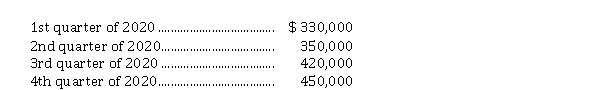

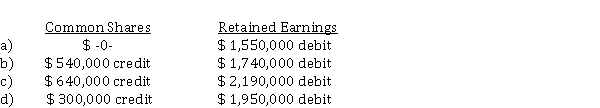

Cash dividends declared on the no par value common shares of Athens Corp. were as follows:  The 4th quarter cash dividend was declared on December 20, 2020, to shareholders of record on December 31, 2020, to be paid on January 9, 2021. In addition, Athens declared a 10% common stock dividend on December 1, 2020, when there were 400,000 shares issued and outstanding, and the market value of the common shares was $ 16 per share. The shares were issued on December 21, 2020. What was the effect on Athens' shareholders' equity accounts during 2020 as a result of the above transactions?

The 4th quarter cash dividend was declared on December 20, 2020, to shareholders of record on December 31, 2020, to be paid on January 9, 2021. In addition, Athens declared a 10% common stock dividend on December 1, 2020, when there were 400,000 shares issued and outstanding, and the market value of the common shares was $ 16 per share. The shares were issued on December 21, 2020. What was the effect on Athens' shareholders' equity accounts during 2020 as a result of the above transactions?

Definitions:

Subsidiary

A company that is controlled by another company, known as the parent company, through ownership of a majority of its voting stock.

Consolidation Purposes

The process of combining and presenting the financial statements of a parent company and its subsidiaries as one single entity's financial statements.

Voting Power

Refers to the rights of shareholders to vote on corporate matters, typically exercised during annual general meetings and special resolutions.

Investments In Associates

Investments where the investor has significant influence (typically 20-50% ownership) over the investee but does not control it.

Q2: What was the name of the communist

Q4: The Indian Self-Determination and Educational Assistance Act

Q10: Nixon responded to stagflation by _ .<br>A)

Q16: Which of the following groups was not

Q22: Who is the five-star general and Supreme

Q22: Who was the first woman to serve

Q23: On January 1, 2020, Halibut Corp. issued

Q25: The largest item in the federal budget

Q69: Intraperiod tax allocation and disclosure<br>Welyhorsky Inc. presents

Q87: Kanye Corp. offers shares on a subscription