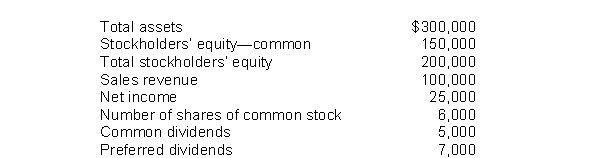

The following information pertains to Benedict Company.Assume that all balance sheet amounts represent average balance figures.  What is the return on common stockholders' equity ratio for Benedict?

What is the return on common stockholders' equity ratio for Benedict?

Definitions:

Listed Property

Assets required to be reported for tax purposes because they have the potential for personal use, such as cars, computers, and real property.

Standard Mileage Rate

The IRS-set rate per mile that taxpayers can use to calculate deductions for business, charitable, medical, or moving purposes when using a vehicle.

Depreciation

The accounting method of allocating the cost of a tangible asset over its useful life to account for the decline in value over time.

Lease Payments

Regular payments made by a lessee to a lessor for the use of an asset over a specified period.

Q5: A liability arises when the board of

Q6: Assume that the Kaenzig Corporation uses the

Q21: The contractual rate of interest is usually

Q25: In a recent year, Hart Corporation had

Q87: Kaplan Manufacturing Corporation purchased 2,500 shares of

Q100: If bonds are issued at a discount,

Q102: The depreciable cost of a plant asset

Q191: Salamagundi, Inc.has the following Income Statement (in

Q193: If the straight-line method of amortization is

Q245: Molina Corporation issues 5,000, 10-year, 8%, $1,000