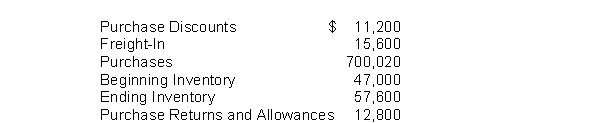

Sampson Company's accounting records show the following for the year ending on December 31, 2022.  Using the periodic system, the cost of goods purchased is

Using the periodic system, the cost of goods purchased is

Definitions:

IRS Requirements

The legal and regulatory stipulations established by the Internal Revenue Service that individuals and organizations must follow.

Defined-Benefit Plan

A type of pension plan in which an employer promises a specified pension payment upon retirement, determined by a formula considering factors like salary and duration of employment.

Cash Balance Plans

A type of defined benefit pension plan that holds an employee's retirement savings as a hypothetical account balance, which grows annually through employer contributions and interest credit rates.

Experienced Employees

Workers who have accumulated significant skill and knowledge in their field through prolonged exposure to various professional situations.

Q25: Anderson Inc.sells $1,200 of merchandise on account

Q49: The specific identification method of inventory costing<br>A)always

Q68: Sales revenue minus operating expenses equals gross

Q72: Under a periodic inventory system, the merchandise

Q82: If a customer agrees to retain merchandise

Q117: The following is selected information from C

Q118: De Meaning Corporation issued a one-year 6%

Q160: Nelson Corporation sells three different products.The following

Q188: Source documents can provide evidence that a

Q210: Oakville Inc.purchased a 12-month insurance policy on