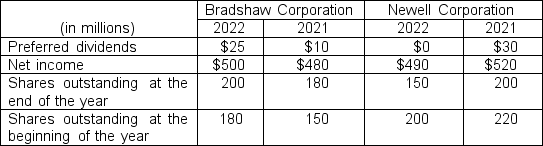

The following information is available for Bradshaw Corporation and Newell Corporation:  Based on this information, the earnings per share calculations (rounded to two decimals) suggest

Based on this information, the earnings per share calculations (rounded to two decimals) suggest

Definitions:

Allowance Method

The allowance method is an accounting technique that enables companies to anticipate and adjust for expected bad debts or credit losses in their financial statements.

Direct Write-off Method

Accounting practice where uncollected receivables are directly written off against income when deemed uncollectible, without using an allowance account.

Bad Debt Expense

A financial accounting concept representing the amount of uncollectible accounts receivable that a company expects to write off as a loss.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of accounts receivable that may not be collectible, reflecting potential losses.

Q28: The normal balance of an asset is

Q42: After transaction information has been recorded in

Q71: Ratios that measure the income or operating

Q79: Giphons Corp.has common stock of $3,500,000, Retained

Q81: When expenses exceed revenues, which of the

Q113: Which of the following is not an

Q126: If a company acquires a 40% common

Q160: Gilkey Corporation began the year with retained

Q208: The balance in the prepaid rent account

Q251: Franklin Company schedules an appointment with High