Use the following information for questions

On January 1, 2021, Marianne Corp.purchased $50,000, of Robin Ltd.'s 4%, 10-year bonds for $48,000, since the market interest rate was approximately 4.5%.The bonds pay interest on January 1 and July 1.Marianne has a calendar year end, and classified the bonds as long-term investments.The fair value on December 31, 2021 was $48,500.Marianne sold the bonds on January 2, 2022 for $48,500.

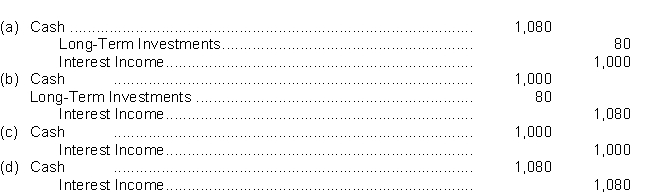

-The entry for the receipt of interest on July 1, 2021 is

Definitions:

Self Competency

The ability to understand and manage one's own abilities and actions effectively.

Personal Computer

A computer designed for use by one person at a time, suitable for general tasks such as writing, internet browsing, and gaming.

Internet Sites

Websites or web pages that are accessible on the internet, providing information, services, or products to users.

Legitimate Power

Authority or influence that is recognized and accepted by others as valid or rightful within a social or organizational context.

Q16: Which of the following statements is true?<br>A)If

Q16: If the cost method is used to

Q28: Property tax payable is classified as a

Q42: Comparisons of company data with industry averages

Q44: Warner's entry to record the purchase would

Q58: Under IFRS, which of the following describes

Q62: The entry for the receipt of interest

Q88: With loans that have equal periodic instalment

Q90: The factor 1.0609 is taken from the

Q132: The Fair Value Adjustment account is a(n)<br>A)offset