Use the following information for questions

On January 1, 2021, Marianne Corp.purchased $50,000, of Robin Ltd.'s 4%, 10-year bonds for $48,000, since the market interest rate was approximately 4.5%.The bonds pay interest on January 1 and July 1.Marianne has a calendar year end, and classified the bonds as long-term investments.The fair value on December 31, 2021 was $48,500.Marianne sold the bonds on January 2, 2022 for $48,500.

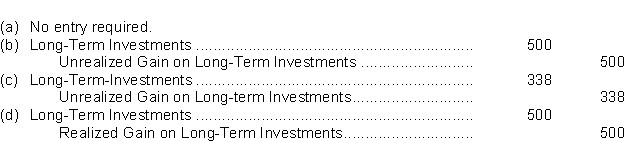

-The entry to adjust to fair value on December 31, 2021 is

Definitions:

Controllable Costs

Costs that can be influenced or controlled by a specific manager or department within an organization.

Unfavorable Controllable Margin

A financial metric indicating that costs or expenses have exceeded budgeted amounts within a manager's control, negatively impacting profitability.

Cost Over Budget

The amount by which actual spending exceeds the planned or budgeted amount.

Sales Exceeding Budget

This indicates a financial scenario where actual sales revenue surpasses the projected figures in the budget, often viewed positively as it suggests higher profitability.

Q14: If the equity method is being used,

Q15: Can the accumulated depreciation of a depreciable

Q24: If the carrying amount of an asset

Q29: A disadvantage of the corporate form of

Q33: If a company has sales of $220

Q37: Which of the following is not true

Q44: Warner's entry to record the purchase would

Q53: To find the balance due from an

Q124: If a company incurs legal costs in

Q148: If a parent company has two wholly