Use the following information for questions

On January 1, 2021, Marianne Corp.purchased $50,000, of Robin Ltd.'s 4%, 10-year bonds for $48,000, since the market interest rate was approximately 4.5%.The bonds pay interest on January 1 and July 1.Marianne has a calendar year end, and classified the bonds as long-term investments.The fair value on December 31, 2021 was $48,500.Marianne sold the bonds on January 2, 2022 for $48,500.

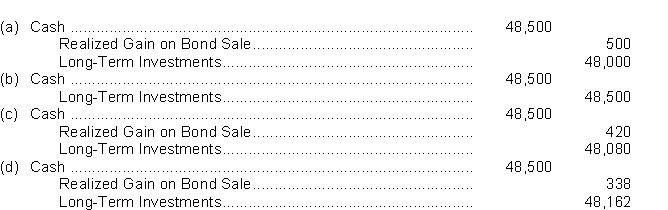

-The entry for the sale of the bonds on January 2, 2022 is

Definitions:

Logical Reasoning

The process of using a structured, systematic approach to arrive at conclusions or solve problems based on valid premises.

What-if Questions

Hypothetical queries used to explore potential outcomes or scenarios, often in planning, problem-solving, and decision-making processes.

Play

A form of activity engaged in for enjoyment, relaxation, or educational purposes, often with rules and interactive elements.

Truth-wins Rule

A principle in group decision-making where the best argument or evidence available overwhelmingly persuades the group, leading to a consensus.

Q5: Both the profit margin ratio and the

Q16: Free cash flow:<br>A)is not a solvency-based measure

Q20: Interest on a 3-month, 3%, $20,000 note

Q62: A debit balance in the Retained Earnings

Q75: If a corporation declares a 10% stock

Q77: Bad Debts Expense is considered<br>A)an avoidable cost

Q80: Cash dividends are not a liability of

Q91: Goodwill<br>A)can be recorded when generated internally.<br>B)can be

Q110: Issue of preferred shares for cash:<br>A)operating activities

Q130: A change in the estimated residual value