Use the following information to answer questions

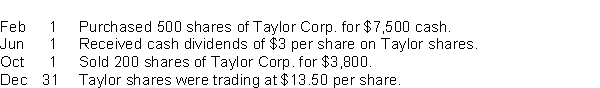

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

-The entry to record the sale of the shares on Oct 1 would include a

Definitions:

Corporate Income

Income earned by a corporation through its business activities, subject to corporate income tax.

Federal Income Taxes

Taxes imposed by the U.S. federal government on taxable incomes of individuals, corporations, and other entities.

State Income Taxes

Taxes levied by individual states on the income of individuals and organizations within their jurisdiction.

Taxation

The system through which government collects money from individuals and businesses to fund public services.

Q4: A truck was purchased for $40,000 and

Q28: When a company has a piece of

Q31: An aging of accounts receivable schedule is

Q33: In calculating cash flows provided (used) by

Q40: When an asset is sold, a gain

Q42: All of the following statements about financial

Q65: Under the equity method,<br>A)the receipt of dividends

Q72: Under the allowance method for uncollectible accounts,

Q125: If the single amount of $2,000 is

Q133: Identify the effect the declaration of a