Use the following information for questions

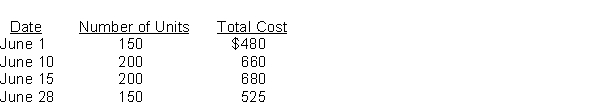

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-Using the FIFO cost formula, the amount of the cost of goods sold for June is

Definitions:

Total Revenue

The total income generated by a firm from the sale of its goods and services, calculated as the selling price per unit times the number of units sold.

Variable Costs

Costs that change in proportion to the level of activity or production volume, such as materials and direct labor.

Average Total Cost

The sum of all production costs (both fixed and variable) divided by the total amount of goods produced.

Average Variable Cost

The total variable costs (costs that change with production levels) divided by the quantity of output produced, representing the per-unit variable cost.

Q4: The primary source of revenue for a

Q12: Roofer's Inc.had an operating line of credit

Q19: Interest expense on a note payable, with

Q53: Which of the following is false about

Q64: When the allowance method is used to

Q68: Recording depreciation on equipment affects both the

Q84: The Dividends Declared account<br>A)appears on the statement

Q95: In order to determine cost of goods

Q95: Goodwill<br>A)is always expensed upon purchase.<br>B)can be sold

Q101: Freight In is subtracted from the Purchases