-

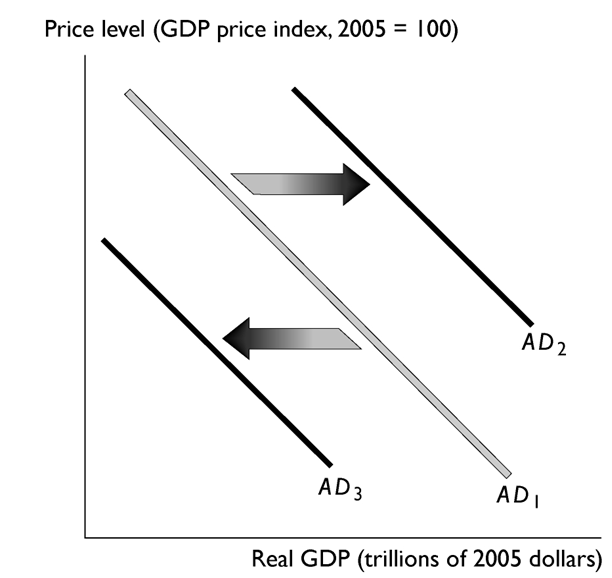

In the figure above, the shift in the aggregate demand curve from AD1 to AD3 could be the result of

Definitions:

Capital Markets

Markets where individuals and institutions trade financial securities, including stocks and bonds, over long periods.

Maturities

The specific dates on which the principal or nominal amounts of financial instruments like bonds or loans are due to be paid to holders.

Short-Term Securities

Financial instruments, such as Treasury bills or commercial paper, that have maturities of one year or less.

Money Markets

Financial markets where short-term debt instruments, typically with maturities of one year or less, are traded.

Q1: When U.S. real GDP increases, U.S. imports<br>A)increase

Q21: Suppose potential GDP is $100 billion and

Q33: The average number of times in a

Q41: The last U.S. president to be in

Q63: On January 1, Rick's Photo owned $50,000

Q72: The greater the tax wedge, the<sub>--------------------</sub>the amount

Q72: When aggregate planned expenditure is less than

Q98: The monetary base is equal to<br>A)the sum

Q99: A currency drain occurs when the<br>A)Fed increases

Q113: To show how a variable <sub>--------------------</sub>, we