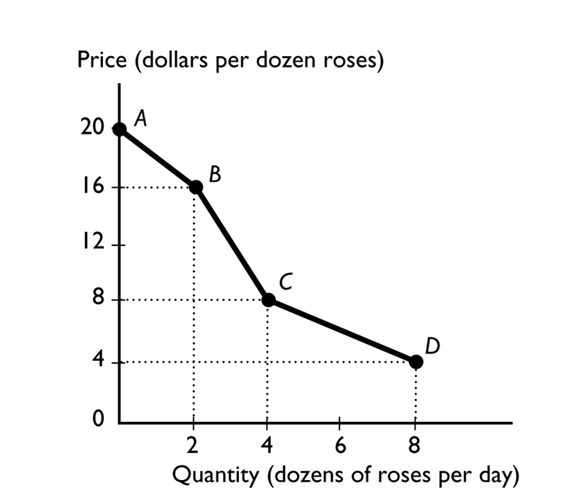

The figure above shows the relationship between the price of a dozen roses and the quantity of roses a florist can sell. The slope between points B and C equals

Definitions:

Income Tax Expense

The cost incurred by businesses and individuals due to earnings taxed by federal, state, and local governments.

Short-Term Note Payable

A debt obligation that is due within one year or less, typically used for working capital needs or to finance short-term liquidity requirements.

Specified Amount

This term refers to a particular or agreed-upon sum of money in various financial contexts.

Income Tax Expense

The amount of money that a company reports as an expense for paying state, federal, and foreign income taxes.

Q4: Eastwood Company has the following information for

Q16: Suppose the relationship between a person's age

Q21: Total contribution margin is calculated by subtracting<br>A)

Q23: What happens to the demand for loanable

Q33: The average number of times in a

Q41: Suppose nominal GDP is $2,000 a year

Q43: Refer to Figure 8-2. What is the

Q110: Excess reserves are the<br>A)same as the required

Q118: Every day<sub>--------------------</sub> adjusts to make the quantity

Q121: If the Fed buys government securities from