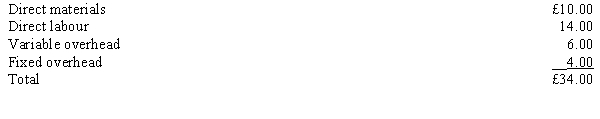

Harris Company uses 5,000 units of part AA1 each year. The cost of manufacturing one unit of part AA1 at this volume is as follows:  An outside supplier has offered to sell Harris Company unlimited quantities of part AA1 at a unit cost of £31.00. If Harris Company accepts this offer, it can eliminate 50 per cent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for £24,000 per year. If Harris Company accepts the offer of the outside supplier, annual profits will

An outside supplier has offered to sell Harris Company unlimited quantities of part AA1 at a unit cost of £31.00. If Harris Company accepts this offer, it can eliminate 50 per cent of the fixed costs assigned to part AA1. Furthermore, the space devoted to the manufacture of part AA1 would be rented to another company for £24,000 per year. If Harris Company accepts the offer of the outside supplier, annual profits will

Definitions:

Accounts Receivable

Money owed to a company by its debtors for goods or services that have been delivered or used but not yet paid for.

Bonds

Fixed-income investments representing a loan made by an investor to a borrower, typically corporate or governmental, with terms defining the interest rate and maturity date.

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding cost of goods sold (COGS).

Tax Liability

The total amount of tax that an individual or corporation is legally obligated to pay to an authority as the result of the occurrence of a taxable event.

Q6: Refer to Figure 25-3. What is

Q10: The range of operations within which a

Q30: Refer to Figure 7-2. What is the

Q48: <br><br>The figure above shows the production possibilities

Q52: _ is the process of identifying, describing,

Q68: Activity-based management attempts to<br>A) identify and eliminate

Q70: Which of the following BEST describes macroeconomics?<br>A)It

Q75: When Fresh Express Salads decides to mechanically

Q95: The total amount spent on new capital

Q98: Which of the following factors changes saving